Financial data is a critical component in the creation of machine learning models for trading. These models rely on historical data to make predictions about future market trends, so the quality and quantity of the data is essential for their accuracy. The financial data used for creating models using the Deep Signal Library can vary substancially, however please keep in mind the following.

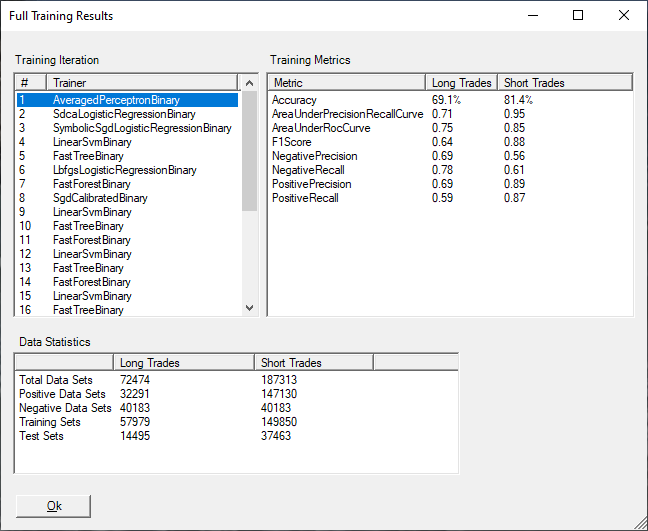

In general, the more data that is available, the better equipped the machine learning model is to identify patterns and make predictions. If the model is created using only a week of data that might be fine for 5 second bars but will probably not be enough for using 1 day bars. You will have to experiment with your data set to be sure it includes enough data to train the model. You can check the Data Statistics section of the Training Results dialog to see how many positive and negative data sets were used for training the model. The positive data sets are those that reached a set profit target and the negative data sets are those in which the price did not reach the profit target.

Accurate financial data is also crucial in the training phase of the machine learning model. The model is trained using historical data to identify correlations between market trends and various indicators. If the data is incorrect or inconsistent, the model may produce incorrect predictions that could lead to significant losses in stock trading. It's important to ensure that the financial data is reliable and up-to-date to increase the chances of the model making accurate predictions. The Deep Signal Library will not include data that varies considerably between bars.

One other aspect is looking at the overall trend of your data set. If the data that is included is only trending in a positive direction then how would you expect the model to perform in a bull market trend? You could either identify a trend in NinjaScript and then use a particular model that suits the trend or train your model with data from both bull and bear trends.

In conclusion, financial data is a crucial component in the creation of machine learning models for trading. The quantity and quality of the data directly affect the accuracy of the model's predictions. Therefore, it's important to use accurate, reliable, and up-to-date financial data to train the machine learning model and improve its performance in the stock market.